-

No. of units:111Developer:Tribute CommunitiesAddress:1588 Bloor St, Courtice, ON L1E 2S3Added to Compare ListCompare

-

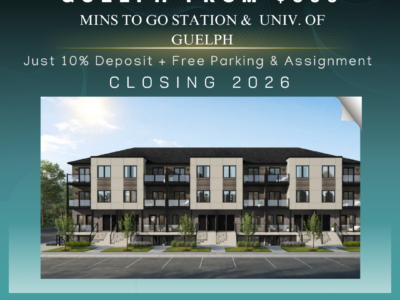

Developer:Reid Heritage HomesAddress:Lowes Rd E & Gordon Street, GuelphAdded to Compare ListCompare

-

Price:$600,000Developer:Treasure HillAddress:401 Dundas Street South CambridgeAdded to Compare ListCompare

-

-

Developer:JD Development GroupAddress:52 Lakeside Terrace, Barrie, ONAdded to Compare ListCompare

-

Developer:The Daniels CorporationAddress:Mississauga Rd & Bovaird Dr W, Brampton, ONAdded to Compare ListCompare

-

Developer:CentreCourt DevelopmentsAddress:1355 Kingston Rd, Pickering, ONAdded to Compare ListCompare

-

Developer:MetropiaAddress:1406 Yonge St, Toronto, ONAdded to Compare ListCompare

-

Price:From the $400’sStoreys:30Developer:Rosehaven HomesAddress:71 Rebecca St, Hamilton, ONAdded to Compare ListCompare

-

Storeys:25Developer:The Daniels CorporationAddress:2475 Eglinton Ave W, MississaugaAdded to Compare ListCompare

-

Completion:2028Developer:Menkes and QuadRealAddress:Interchange Way & Highway 7, Vaughan, ONAdded to Compare ListCompare

-

Storeys:23Developer:Skale Developments & Diamante DevelopmentAddress:2790 Kingston Rd, Toronto, ONAdded to Compare ListCompare

-

Completion:2028No. of units:1950Storeys:84Developer:Great Gulf, WestdaleAddress:260 King St W, TorontoAdded to Compare ListCompare

-

Completion:2029No. of units:302Storeys:27Developer:Capital DevelopmentsAddress:717 Church St, Toronto, ONAdded to Compare ListCompare

-

Price:From $500sDeveloper:Mattamy HomesAddress:Dundas St & Ninth Line, Oakville ON L6H 7G2Added to Compare ListCompare

-

-

Developer:CaivanAddress:1700 Bovaird Dr W, Brampton, ON L7A 2Y7Added to Compare ListCompare

-

Storeys:2Developer:GeraniumAddress:Brock Rd & Central St PickeringAdded to Compare ListCompare

-

No. of units:210Storeys:11Developer:Mattamy HomesAddress:935 The Queensway, EtobicokeAdded to Compare ListCompare

-

Developer:Tribute CommunitiesAddress:Liverpool Rd and Kingston Rd, Pickering, ON L1V 1V9Added to Compare ListCompare

-

Price:From $900sDeveloper:Arista, Deco & OpusAddress:Gore Rd & Cottrelle Blvd Brampton ONAdded to Compare ListCompare

-

Price:From CAD $499,990No. of units:387Storeys:7Developer:National HomesAddress:490 Plains Rd E, Burlington, ONAdded to Compare ListCompare

-

No. of units:642Storeys:25Developer:The Daniels CorporationAddress:365 Parliament St, Toronto, ONAdded to Compare ListCompare

-

No. of units:819Storeys:68Developer:Reserve Properties and Capital DevelopmentsAddress:8 Elm Street, Toronto, ON M5G 1G7Added to Compare ListCompare